The term GFV (Guaranteed Future Value) is becoming more popular by the day; however, not many people quite understand the concept of a GFV and all the intricacies that follow it.

In layman’s terms, GFV is the Rand value of a vehicle that an OEM (Original Equipment Manufacturer) can guarantee a customer after a certain period. The concept of a GFV is usually, at least in the South African landscape, attached to vehicle finance leasing schemes, such as Mercedes-Benz Agility and BMW Select Finance, to mention a few.

It's important to note that a GFV carries strict terms and conditions, usually in the form of set mileage restrictions over the contract period and the overall condition of the vehicle. To best understand GFV, we’ll use a fictitious practical example.

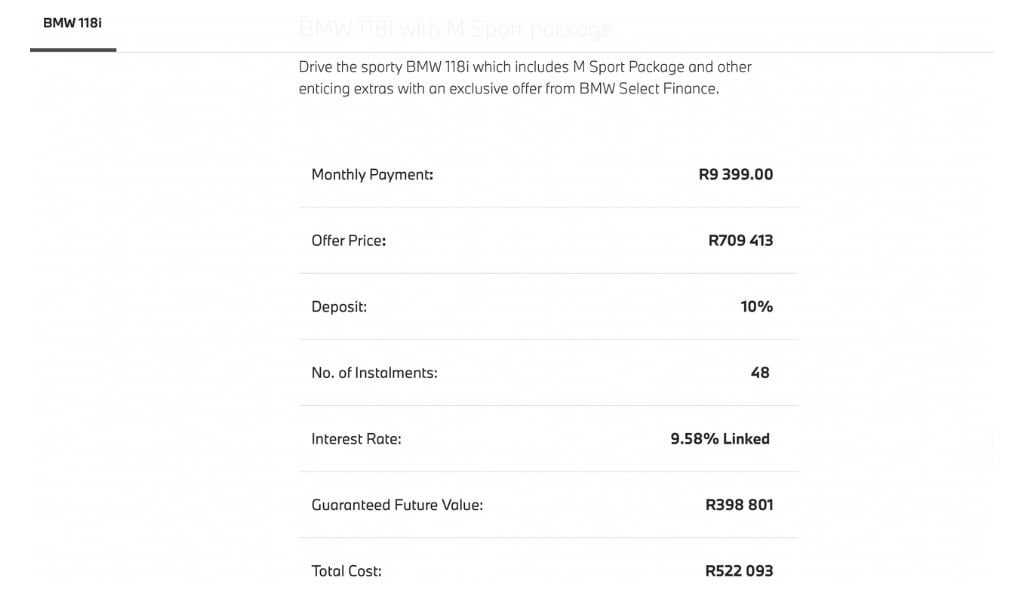

Nthabiseng has just landed her dream corporate job and wants to purchase a premium hatchback to celebrate her career milestone. Being a BMW fan, she visits the BMW website to research a BMW Select deal based on the current generation 118i with M Sport package. The retail price listed online is R709,413, with monthly repayments of R9,399 over 48 months and a 10% deposit. The interest rate is listed at 9.58% linked.

A GFV value of R398,801 has been listed, which means that at the end of 48 months, BMW will guarantee Nthabiseng that her BMW 118i M Sport will be worth that value, provided she adheres to the stipulated terms and conditions, which are that she doesn’t accumulate more than 80,000km by the end of her contract period. BMW will also consider a vehicle's normal wear and tear, so Nthabiseng does not need to worry about fine scratches caused by her local car wash.

At the end of the 48 months, due to the deal being a lease, Nthabiseng could either return her beloved BMW 118i and walk away with nothing, or she could also settle the remaining balance of the vehicle and keep it or trade up to a newer model. Finance models which offer consumers a GFV are beneficial in that they take away the burden of depreciation while giving consumers flexibility when it comes to mobility and more affordable financing. For the OEMs, a GFV represents trust in their products, which the consumer will most likely appreciate.

Traditional vehicle financing, however, doesn’t offer GFV, which, to some, could be a good or bad thing. This then ties into the topic of whether one should purchase a vehicle in the traditional manner of financing it over 5-8 years and taking ownership at the end of the period or whether newer finance models such as BMW Select Finance and Toyota KINTO make more sense financially, a topic we’ll be diving into another day…