New vehicles sales crashed heavily in March and, although some blame can be attributed to the Easter holidays, as the barometer of business confidence in the country, those numbers do not bode welll – and may be exacerbated this month with both an electricity price and fuel price hike for embattled consumers to contend with.

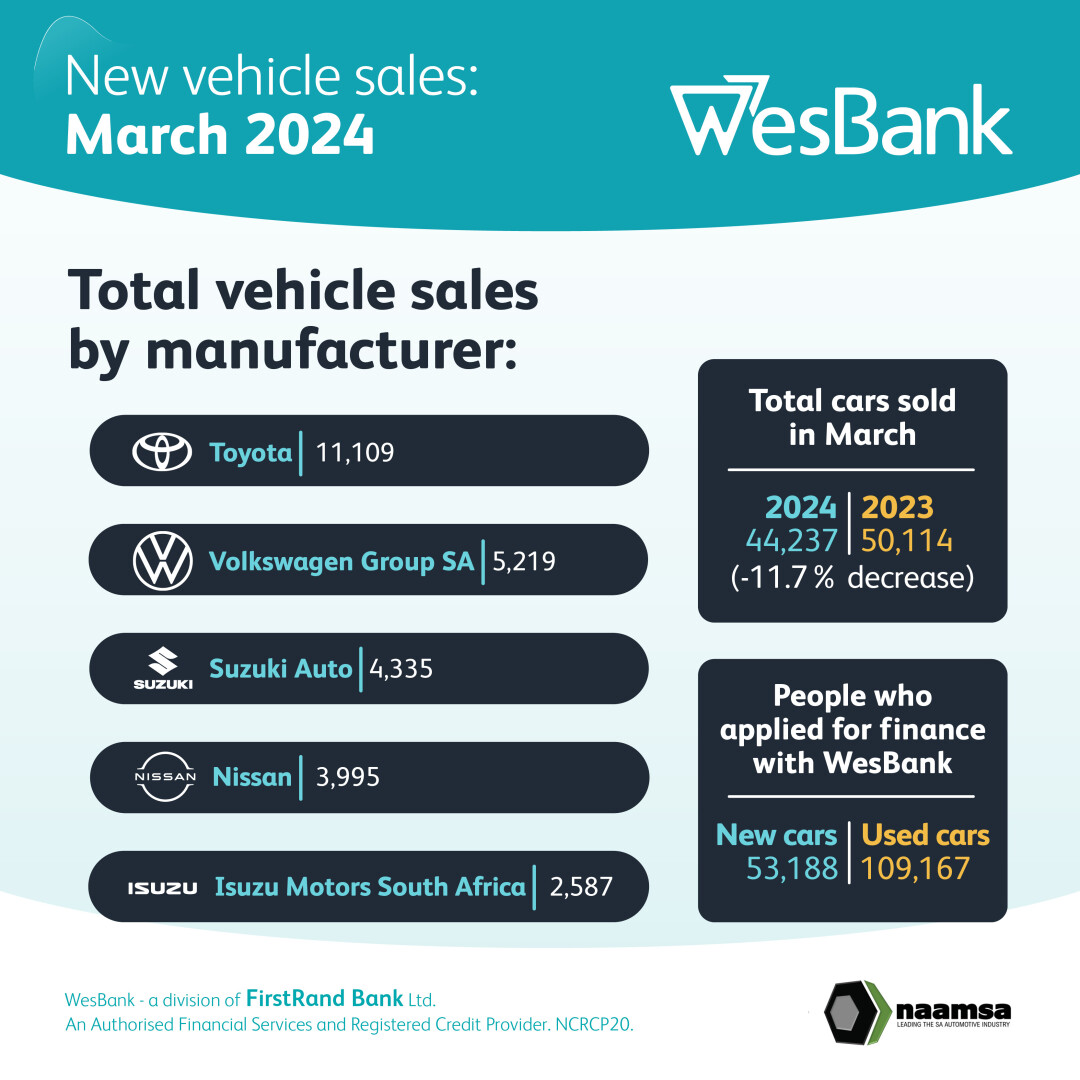

naamsa reports the new vehicle market faced challenges in March 2024 due to a constrained business environment and subdued consumer demand compounded by the recent Easter holidays. Sales figures showed a notable decline compared to March 2023, with domestic sales dropping by 11,7% and export sales by 27,1%.

Need to finance your new car? Look no further.

Of the total reported industry sales of 44,237 vehicles, dealer sales represented the majority at 88,2%, followed by sales to the vehicle rental industry (6,0%), government (3,5%), and industry corporate fleets (2,3%).

In March 2024, new passenger car sales decreased by 15,9%, while sales of light commercial vehicles saw a more moderate decline of 4,3%. The medium and heavy truck segments also experienced reductions in sales compared to the previous year.

Despite the overall decline, there were some positive signs amidst the challenges.

WesBank noted while March sales appeared alarming at first glance, they were only marginally down compared to February. Additionally, the light commercial vehicle market showed resilience, with year-to-date numbers down by just 0,2% for the first quarter.

Brandon Cohen, Chairperson of NADA, praised the resilience of South Africa's franchised motor dealers in navigating the difficult market conditions, highlighting their remarkable performance in achieving sales amid the challenges, attributing it to robust sales incentive programs and the introduction of new models.

Budget under pressure? Check out our large selection of well-price pre-owned vehicles.

Budget under pressure? Check out our large selection of well-price pre-owned vehicles.

Cohen also mentioned some positive indicators for the future, such as increased sales volumes for Heavy Commercial Vehicles and Buses compared to the previous year, and favorable economic developments such as the SARB's decision to hold interest rates steady and the impending discontinuation of e-Tolls.

Despite the ongoing challenges, Cohen emphasized the enduring strength and adaptability of South Africa's franchised motor dealers and expressed optimism for the future growth of the retail automotive sector.

“The effect of the South African Reserve Bank’s aggressive monetary policy stance by hiking interest rates in an attempt to contain inflation took some time to filter through to new vehicle sales, which continue to add to the prevailing negative sentiment. Due to ongoing cost pressures, including escalating fuel costs, along with interest rates, affordability remains a decisive factor in purchasing decisions as consumers increasingly turn to more budget-friendly vehicles,” says naamsa.

“South Africa’s economic growth outlook for 2024 remains mooted, but at a projected 1,2% by the SA Reserve Bank it would still be stronger than 2023. Only once the interest cutting cycle commences, likely during the second half of the year, along with the easing of inflation, better economic prospects are expected for the new vehicle market.

“This is underscored by the Absa Purchasing Managers’ Index (PMI) which reflected a further improvement in sentiment towards business in six months’ time, which rose to its most upbeat level since the start of 2023.”

Colin Windell

Proudly CHANGECARS