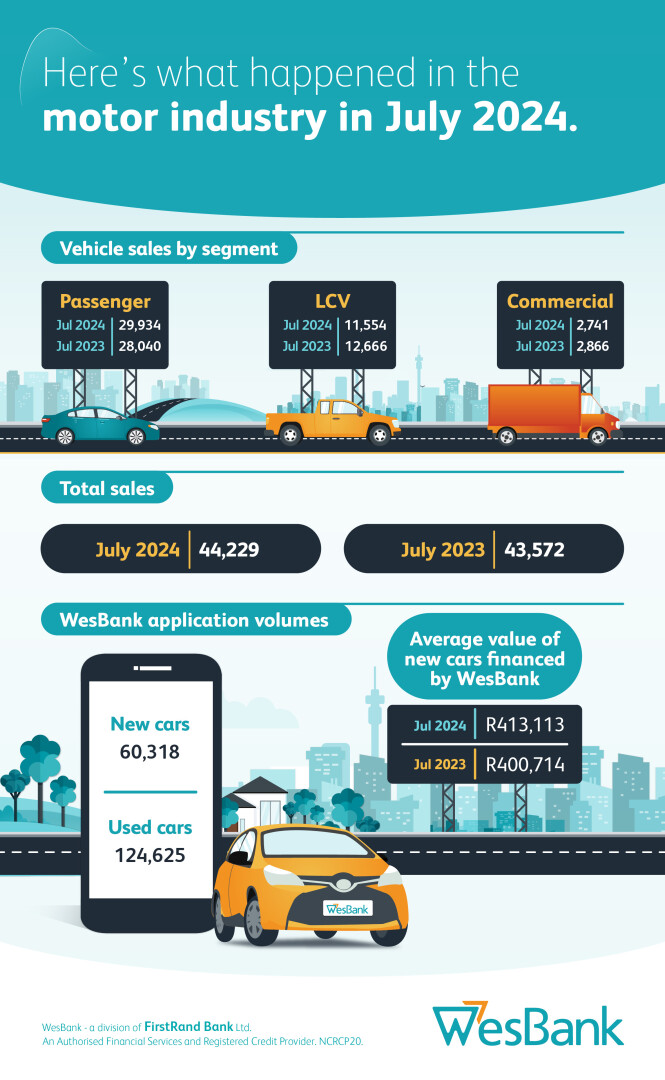

There has been a collective sigh of relief from auto dealers as the market picked up through July seeing a gain of 1,5% compared to the same month last year – a modest gain but more encouraging in the passenger car segment where it climbed by 6,8%.

"Finally, in July, we witnessed a positive shift in monthly retail new vehicle sales," commented Brandon Cohen, national chairperson of the National Automobile Dealers Association (NADA), following the release of the sales figures by naamsa | The Automotive Business Council.

"Although the increase was modest at 1,5% compared to the same month last year, the sale of 44 229 units is encouraging. When compared to June 2024 sales, July witnessed an overall increase of 4 356 vehicles with passenger vehicles accounting for 3,171 units.

Looking for a good quality pre-owned vehicle - click here

“Year-to-date, we remain 6.3% behind the figures for 2023, but we are hopeful that the July sales mark the beginning of growth in the second half of the year. Despite this, with a year-to-date deficit of 6,3%, we have significant ground to cover before the year’s end."

"Consumers are beginning to visit dealerships more frequently. Confidence in the country and overall sentiment is improving, leading people to return gradually to car purchases. However, high interest rates and the unsustainably high cost of living continue to impact vehicle finance accessibility. While there is a clear desire for vehicles, affordability remains a significant barrier.

"There are positive indications that interest rates may be reduced by 25 to 50 basis points before the year ends, and some consumers are already factoring this potential change into their purchasing decisions.”

Toyota remained the top seller in July - we have a great selection of pre-owned models

What is of concern is the decline in sales of new light commercial vehicles, bakkies and mini-buses that showed a loss of 8,8% compared to July 2023.

Sales for medium and heavy truck segments of the industry also performed weaker in July dropping 6,6% in the case of medium commercial vehicles and 3,7% for the heavies – this segment the real barometer of the state of the economy.

Encouraging aspects for growth and increased consumer spending for the balance of the year include four consecutive months of no load shedding, a stronger Rand exchange rate and potentially up to two interest rate cuts before year-end.

South African motorists continue to remain under immense budget pressures amid interest rates at a 15-year high. Moreover, there is not much relief expected soon.

“Whilst soft economic growth and inflation data indicate the real possibility now for interest rate cuts, with only two opportunities in September and November, consumers shouldn’t expect big savings to become a reality this year,” says Lebo Gaoaketse, head of Marketing and Communication at WesBank.

“Whilst soft economic growth and inflation data indicate the real possibility now for interest rate cuts, with only two opportunities in September and November, consumers shouldn’t expect big savings to become a reality this year,” says Lebo Gaoaketse, head of Marketing and Communication at WesBank.

“The market’s performance during July should be seen in two important contexts. Firstly, July 2023 was practically the last month the South African car market was in growth territory, making this July’s performance relatively stronger. Secondly, July sales were a substantial 4 157 higher than June, which is significantly more than the 657-unit growth year-on-year.”

Colin Windell

Proudly CHANGECARS